Content

Precious has a Bachelors in Business Administration in Accounting from Hofstra University. She is an auditor and has experience with both private and public accounting. Balance sheets point to a specific moment in time, which is typically the end of a quarter, six-month period, or year. https://kelleysbookkeeping.com/ Let’s imagine that ACME Inc. sells $10,000 of wood to XYZ Furniture Ltd. The second notation, usually used after the discount notation, means the net amount must be paid within 30 days or how many days you decide. A perfect way to demonstrate what this would mean is to show an example.

What is an example of an accounts receivable process?

The accounts receivable process involves customer onboarding, invoicing, collections, deductions, exception management, and finally, cash posting after the payment is collected. There are a lot of other steps involved as well, like bad debt management, writing off accounts, etc.

A high turnover ratio indicates that a business is more conservative in extending credit or more aggressive in collections. Most businesses provide goods or services before they invoice their clients. The funds due are recorded as a current asset to offer insight into the financial condition of the company.

account receivable

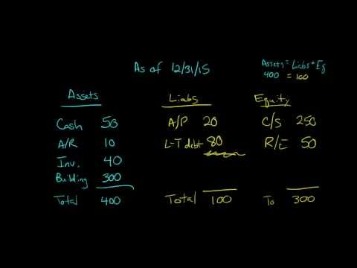

The company will make records of the account receivable, all the unpaid invoices that the client needs to pay. Accounts payable and debts are liabilities on your balance sheet because it’s money your company owes to others. A second issue with the ratio is that it does not include any information about customer behavior.

- Receivables financing solutions can significantly speed up cash flow, allowing businesses to invest the collected money more quickly.

- This is done to calculate the net amount of accounts receivable anticipated to be collected by your business.

- Receivables are prized by lenders, because they are usually easily convertible into cash within a short period of time.

- Thus, the Bad Debts Expense Account gets debited and the Allowance for Doubtful Accounts gets credited whenever you provide for bad debts.

They paid cash.4The company paid its supplier for its cream and sugar.5Frozen Delights paid its entire balance on time. If XYZ pays on time, i.e., thirty days later, ACME will increase cash by $10,000 while reducing accounts receivable by the same amount. Accounts payables and receivables likely make up the bulk of your current liabilities and assets, so effectively managing them is key to having sufficient working capital. You can have both short-term and long-term notes receivable, but accounts receivables are always short-term.

How are accounts receivable different from accounts payable?

Typically, accounts receivable are due in 30 to 60 days and considered well overdue past 90, but time frames can vary based on industry. Lastly, if the receivables are paid back after the discount period, we record it as Understanding Accounts Receivable Definition And Examples a regular collection of receivables. This is what the initial purchase of inventory would look like in the journal entry. We excluded the terms in the description portion of our journal entry because it is optional.

Accounts receivable and accounts payable are essentially on opposite sides of the balance sheet. While accounts receivable is money owed to your company , accounts payable is money your company is obligated to pay . In journal entry form, an accounts receivable transaction debits Accounts Receivable and credits a revenue account. When your customer pays their invoice, credit accounts receivable and debit cash (to recognize that you’ve received payment).

What is the Accounts Receivable Process?

After the goods or services have been delivered, the company will send an invoice to the customer detailing the amount owed. The AR process starts when a company sells a good or service and includes payment terms, discounts or credit guidelines in an invoice to the customer. When payments arrive, receipts need to be returned and the payment needs to be recorded. Accounts receivable is the money that a business is owed by its customers.

Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation. Create a formal, written policy for collections, and enforce the policy. We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions.

Leave A Reply (No comments so far)

You must be logged in to post a comment.

No comments yet